公司简介

新加坡诚信会计师事务所 (FAC Assurance Public Accounting Corporation) ,是新加坡唯一一家中国人自己开办的具有审计资格的新加坡政府特许的会计师事务所,由有资质的专业人士提供审计、会计、新加坡公司注册、注册离岸公司、公司秘书、税务代理等一站式服务。

我们的宗旨:诚以待人,信以处事。

我们的服务包含:审计报告,综合报告,会计账目,财务报表,公司秘书,新加坡注册公司,离岸公司注册(英属维京群岛、马绍尔群岛、安圭拉、塞舌尔、开曼等)、税务代理,代理董事,商务咨询等。新加坡注册公司机构同时提供:注册离岸公司办理流程、每年费用,新加坡公司注册查询、新加坡公司注册价格等。

公司创建人葛永钧先生来自中国青岛,澳洲国立大学工商管理硕士,新加坡政府特许执业注册会计师,是新加坡会计师协会(ISCA)及英国特许公认会计师协会(ACCA)双重资深会员。 查看详情

2022-02-24

新加坡注册公司移民_注册新加坡公司优势

2022-02-24

新加坡注册维修公司吗_如何在新加坡注册公司

2022-02-24

新加坡公司注册码是哪个_如何注册新加坡公司

2022-02-24

新加坡公司注册法人要求学历_1、注册新加坡公司条件

2022-02-24

新加坡公司可以注册中文名吗_新加坡注册离岸公司所自需材料

2022-02-24

新加坡注册公司跟离岸有什么区别_注册新加坡公司和香港公司的区别

2022-02-24

新加坡注册公司注意事项_新加坡注册公司有哪几个注意事项

2022-02-24

新加坡注册私募基金公司流程_新加坡基金公司所需材料

2022-02-24

在新加坡注册公司大概需要多少钱_到新加坡怎么注册公司

2022-02-24

怎么注册新加坡公司有哪些_注册新加坡公司

2022-02-24

注册新加坡个公司_注册新加坡公司说明书

2022-02-24

新加坡创业注册公司_如何注册新加坡公司

2022-02-24

怎么样注册新加坡公司_新加坡公司

2022-02-24

新加坡注册公司官网_杭州注册一家公司需要准备什么资料

2022-02-24

新加坡注册公司税费_新加坡公司

2022-02-24

怎么样去注册新加坡公司吗_注册新加坡公司有什么注意事项

2022-02-24

新加坡公司注册找亚港_大陆人怎么注册新加坡公司

2022-02-24

新加坡注册的公司有税号吗_注册新加坡公司

2022-02-24

新加坡注册公司后缀是什么意思_注册新加坡公司

2022-02-24

在新加坡注册公司什么签证_新加坡注册公司需要什么条件

2022-02-24

怎样查新加坡注册公司_注册新加坡公司需要什么手续

2022-02-24

新加坡国内公司注册_注册新加坡公司

2022-02-24

中国在新加坡注册公司_为什么要注册新加坡公司

2022-02-24

新加坡注册环保公司吗_“离岸公司注册新贵”新加坡公司注册流程是什么

2022-02-24

新加坡注册公司流程和费用_注册新加坡公司

2022-02-24

新加坡注册公司经营范围_注册新加坡公司资料

2022-02-24

新加坡注册公司优缺点_注册新加坡公司具体要求

2022-02-24

新加坡公司哪里注册_注册新加坡公司流程

2022-02-24

在新加坡注册公司然后去工作_新加坡离岸公司在国内怎么注册

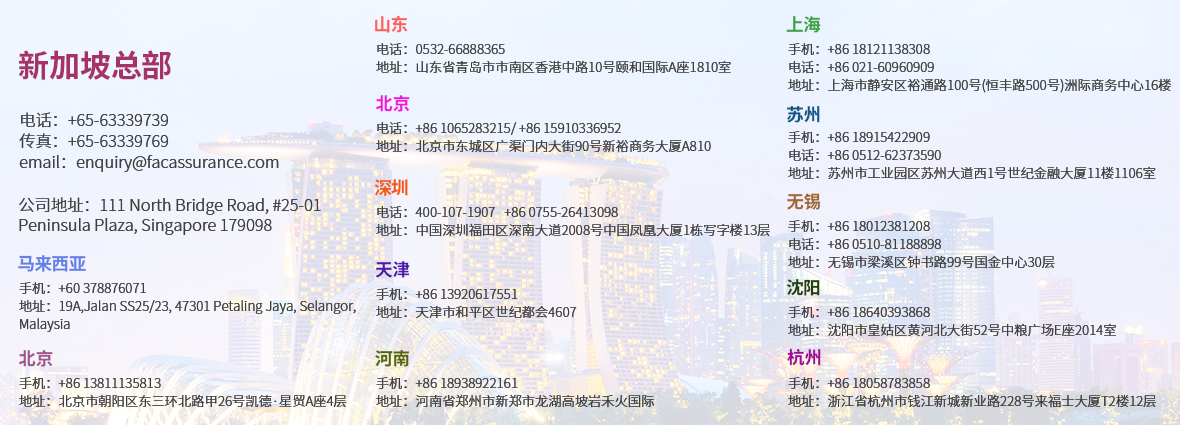

联系我们

| 联系人: | FAC Assurance PAC Chartered Accountants of Singapore |

|---|---|

| 电话: | +65-63339739 |

| 传真: | +65-63339769 |

| Email: | admin@facassurance.com |

| 微信: | faithfulaccounting |

| 地址: | 111 North Bridge Road, #25-01 Peninsula Plaza, Singapore 179098 |

一带一路国际商学院 荣誉证书

新加坡海关

新加坡海关 新加坡税务局

新加坡税务局 新加坡教育部

新加坡教育部 微信

微信